- Why OTC Crypto Exchanges are Gaining Popularity

- Cost to Build an OTC Crypto Exchange Platform - A Detailed Breakdown

- Essential Features of OTC Crypto Exchange Platform

- Technology Stack for OTC Crypto Exchange Development

- Key Points to Consider When Building an OTC Crypto Exchange Platform

- Ways to Gain an Edge Over Competitors in the OTC Crypto Exchange Industry

- White-Label vs Custom-Built OTC Crypto Exchange: Which Should You Choose?

- White Label OTC Crypto Trading Platform

- Custom-Built OTC Crypto Exchange

- Which is Right for You?

- FAQs

As the world of cryptocurrency continues to evolve, the demand for Over-the-Counter (OTC) crypto exchanges has surged. Unlike traditional exchanges that are open to all traders and often suffer from market slippage when large trades are executed, OTC exchanges cater specifically to institutional investors, high-net-worth individuals, and corporate traders who need to make large transactions in a private, secure, and stable environment. Investors for whom discretion and favorable pricing are essential.

In this comprehensive guide, we’ll explore every facet of successful OTC crypto exchange development. From understanding the market need, to an in-depth analysis of the development costs, essential features, and technologies, we’ll help you navigate the complex world of OTC platforms.

Let’s take a deep dive into each of these areas to get you the understanding needed to build and launch a successful crypto OTC trading platform.

Why OTC Crypto Exchanges are Gaining Popularity

The cryptocurrency ecosystem is expanding rapidly, and the need for over-the-counter crypto exchanges has grown alongside this shift. While large crypto exchanges such as Binance, Kraken, and Coinbase dominate the retail trading landscape, they are not suitable for large investors and institutions that need to execute high-value trades discreetly and without triggering significant price swings.

An over-the-counter trading platform offers a solution to this by providing:

- Private Transactions: OTC trades occur off the public order books, which means that the trades don’t impact the open market, thus protecting the privacy of the buyer and seller.

- Large Liquidity: These exchanges provide access to deep liquidity pools, which is essential for executing large transactions without significant slippage or price volatility.

- Personalized Services: OTC platforms often cater to high-net-worth individuals (HNWIs) and institutional investors by offering customized services such as tailored pricing, dedicated account managers, and faster transaction processes.

- Regulatory Compliance: OTC exchanges are designed to adhere to financial regulations such as KYC and AML laws, making them a preferred choice for institutions that prioritize regulatory compliance.

For entrepreneurs looking to invest in OTC crypto exchange trading platform development, there’s a clear opportunity to build a platform that caters to this growing demand. Moreover, the shift towards large institutional and corporate adoption of cryptocurrencies as an asset class is creating an environment where the market is primed for platforms that can handle large-scale transactions with minimal hassle and maximum security.

Building a secure crypto trading platform, however, comes at a cost, which is usually on the higher end of the spectrum. Let’s get you clarity on it.

Also Read: Cost to build a crypto exchange app like Coinbase

Cost to Build an OTC Crypto Exchange Platform – A Detailed Breakdown

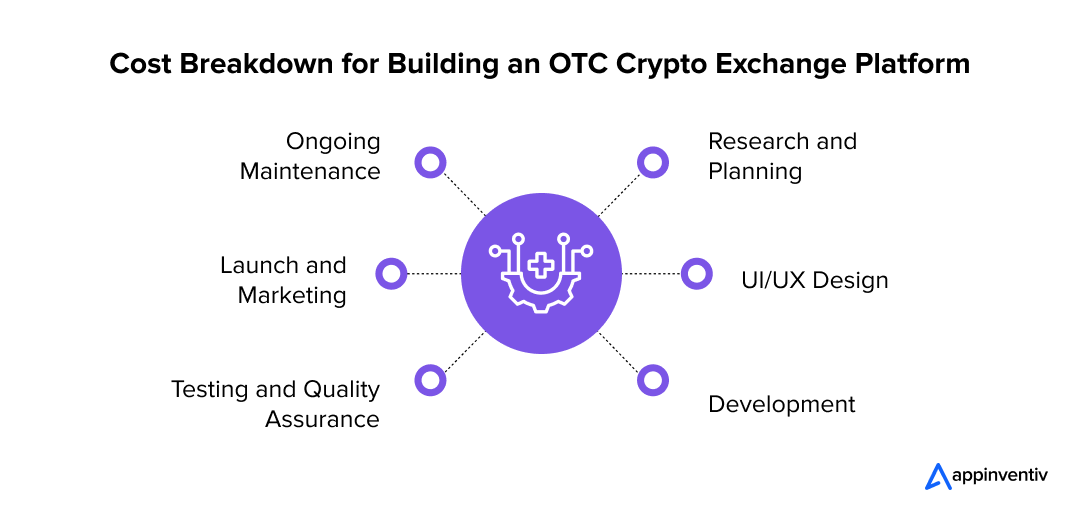

Custom OTC exchange solution development is a significant financial and time investment, which demands transparency of the spend. To fully understand the overall cost of building a high-quality, secure, and user-friendly platform, which can come out to be roughly $40,000 to $500,000+, it’s essential to break down the OTC crypto exchange trading platform development process into stage-wise costs.

Stage 1: Research and Planning (Cost: $5,000 – $30,000)

This stage involves the initial groundwork needed to launch a crypto exchange:

- Market Analysis: Understanding the demand for OTC crypto trading, identifying target audiences (institutions, HNWIs, traders), and studying competitors.

- Regulatory Research: Understanding the legal requirements for building an OTC platform, such as KYC/AML regulations, data protection laws, and the specific requirements in different jurisdictions.

- Business Strategy: Crafting the business plan and determining monetization strategies (e.g., fees per transaction, premium services, or fixed pricing models).

- Platform Roadmap: Designing a roadmap for development, setting milestones, and determining the initial scope of the platform’s capabilities.

This phase of OTC crypto exchange app development sets the foundation for the project’s success and ensures that the platform complies with all necessary regulations and has a clear market positioning.

Stage 2: UI/UX Design (Cost: $8,000 – $50,000)

User interface and user experience design is critical for any exchange platform, particularly OTC exchanges that deal with high-net-worth clients. The user experience must be seamless and intuitive.

- Wireframes & Prototypes: Initial wireframes will map out the platform’s structure, including trading interfaces, dashboards, and order management systems. Interactive prototypes will help visualize user journeys.

- Design Iterations: High-level design will include branding, color schemes, typography, and aesthetics that resonate with your target demographic – institutions and large traders.

- Mobile Compatibility: The design will also need to support mobile access, as more institutional clients prefer to monitor their transactions on the go.

Stage 3: Development (Cost: $15,000 – $250,000)

This is where the bulk of your OTC crypto exchange development cost investment will go. The development stage includes both frontend and backend development as well as crucial integrations.

- Backend Development: A secure backend system is necessary to support transactions, order matching, and wallet management. You’ll need to integrate technologies like blockchain, liquidity providers, and crypto wallets. The backend will also ensure scalability to handle increasing transaction volumes.

- Frontend Development: The user-facing part of the platform needs to be responsive and interactive. A clean, easy-to-use interface is essential, even when dealing with complex features like market data visualization and transaction history.

- Liquidity Management Integration: You’ll need to connect with liquidity providers to ensure that your platform can execute large orders without substantial price slippage. This involves integrating APIs from liquidity aggregators or third-party sources.

- Security Infrastructure: Given the high value of transactions on OTC platforms, security is paramount. Multi-layer security features, including encryption, cold storage, and multi-factor authentication, must be implemented to ensure asset protection.

This stage includes all the technical aspects of building the OTC exchange platform, from creating the infrastructure to integrating with third-party services and ensuring secure transactions.

Stage 4: Testing and Quality Assurance (Cost: $5,000 – $50,000)

After development, the OTC trading platform needs rigorous testing to ensure it is secure, scalable, and fully functional.

- Security Testing: Vulnerability assessments, penetration testing, and encryption testing are the critical stages. Any weaknesses in the platform’s security need to be identified and patched before launch.

- Stress Testing: Simulating heavy traffic and transaction volumes to ensure the platform can handle high-stakes OTC trades without crashing.

- Functionality Testing: Ensuring that all features, including real-time trading, wallet management, KYC/AML protocols, and instant transactions, function as intended.

This phase ensures that the platform is secure, reliable, and free of bugs before being made available to users.

Stage 5: Launch and Marketing (Cost: $5,000 – $60,000)

Once the platform is ready, you will need a strategy for a successful launch:

- Deployment: Setting up servers, configuring security measures, and ensuring that the platform is operational 24/7.

- Marketing Campaigns: Targeted marketing for your platform is key to attracting institutional investors, high-net-worth individuals, and liquidity providers. Campaigns you can plan for can include influencer marketing, SEO, email marketing, and direct outreach to potential clients.

The launch phase of OTC trading platform development also includes initial user support and feedback collection to improve the platform’s performance after the first few weeks of operation.

Stage 6: Ongoing Maintenance (Cost: $5,000 – $40,000 per year)

Once launched, the next part of the process to develop an OTC cryptocurrency exchange platform would need regular updates, security patches, and ongoing technical support.

- Security Updates: Ensure the platform remains compliant with evolving regulations and security standards.

- Feature Updates: Adding new features and improving existing ones based on user feedback.

- Customer Support: Offering 24/7 support through email, chat, or phone to assist with any issues users might face during transactions.

Maintenance is a recurring cost that ensures the longevity and security of the secure crypto trading platform.

Now that we have had a high-level view of the over-the-counter crypto exchange development cost, let’s reverse engineer a bit to look into the factors like features and tech stack that would go into this price range.

Essential Features of OTC Crypto Exchange Platform

While we do understand that the exact feature list will vary based on the use cases of crypto OTC exchange development you choose, here’s a list of MVP-level features that can be integrated to build a successful OTC crypto exchange.

1. Trading Mechanisms

The platform should support advanced trading mechanisms like limit orders, market orders, and stop orders. Since OTC trading involves larger transactions, the system should be able to execute these orders discreetly without affecting market prices.

2. Multi-Currency Wallets

Supporting a wide range of cryptocurrencies is essential for an over-the-counter crypto exchange platform. To enable users to deposit, store, and withdraw various digital assets seamlessly, a multi-currency wallet will come handy, one that supports multiple blockchains and tokens.

3. Multi-Layer Security

Given the scale of transactions on OTC platforms, a robust security framework is non-negotiable. Implement a multi-layer security system that includes:

- Cold and Hot Wallet Management: Use a hybrid model of cold wallets (offline storage) and hot wallets (online storage) to balance accessibility and security.

- Encryption: Ensure end-to-end encryption for sensitive data such as user information, transaction details, and financial data.

- Real-Time Fraud Detection: Implement machine learning algorithms to monitor suspicious activities and prevent fraud in real time.

4. Instant Buy/Sell Feature

Allow traders to execute instant buy and sell orders, providing them with the flexibility to complete transactions quickly, especially in volatile markets.

5. Crypto Wallet Integration

In order to make your over-the-counter trading platform well-connected and scalable, it will also help to integrate it with various third-party wallets like MetaMask, Coinbase Wallet, and hardware wallets for smoother deposits and withdrawals.

6. KYC/AML Compliance

Integrate KYC and AML protocols to ensure your platform adheres to global regulations, preventing fraud and money laundering. This is especially important for attracting institutional clients.

7. Support

Offering personalized customer support is crucial for handling large trades. Provide multiple support channels, including email, live chat, and phone support, available 24/7.

8. User and Admin Dashboards

- User Dashboard: A user-friendly dashboard should allow clients to track balances, manage portfolios, monitor ongoing trades, and access transaction history.

- Admin Dashboard: The admin panel should allow for managing user accounts, reviewing transaction data, managing liquidity, and ensuring platform security.

Now that we have looked at one of the most critical aspects of OTC crypto exchange development cost – Features, let us look at the next important element.

Technology Stack for OTC Crypto Exchange Development

Choosing the right technology stack is essential for the over-the-counter trading platform’s security, scalability, and performance. Here’s what we typically choose to build similar platforms.

- Backend Development: Node.js, Python, or Go for server-side development.

- Blockchain Integration: Integrate with multiple blockchain platforms like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP).

- Database: Use PostgreSQL or MongoDB for data storage and transaction management.

- Security Tools: SSL Certificates, 2FA (Two-Factor Authentication), Encryption Algorithms (AES-256).

- Frontend Framework: React.js or Vue.js for building dynamic and responsive user interfaces.

By selecting the right stack, you ensure the platform’s robustness, scalability, and security.

With the features and tech stack for OTC crypto exchange software development part now addressed, let us look at one of the last key cost range deciding factors – the cryptocurrency exchange software development company you will partner with to build the platform.

While it is common knowledge now that outsourcing development to a country like India will be much more cost-effective when compared to getting the product made in the US, you should look for a partner that is not just a one-time vendor. Look for ones you can be associated with for a long-term, someone who has a demonstrated history of working on blockchain and complex crypto exchange platform development projects. Someone like our team at Appinventiv.

At Appinventiv, we have worked on over 20 blockchain projects for a range of industries like Fintech, Healthcare, Hotel, etc. Out of these projects, 2 were cryptocurrency exchange platforms – One dedicated to NFT and other one based on multi-cryptocurrency exchange. The extensive work we have done on the projects have given us a deep-level understanding into the domain, what the users expect, and how businesses can ace in the competitive market.

When you partner with us as your cryptocurrency exchange software development company, you can be rest assured that the association will go beyond deliverables to make your exchange platform a success.

Now, no matter which tech partner you end up choosing, there are some key things that should be kept on priority when working on your OTC crypto exchange app development project.

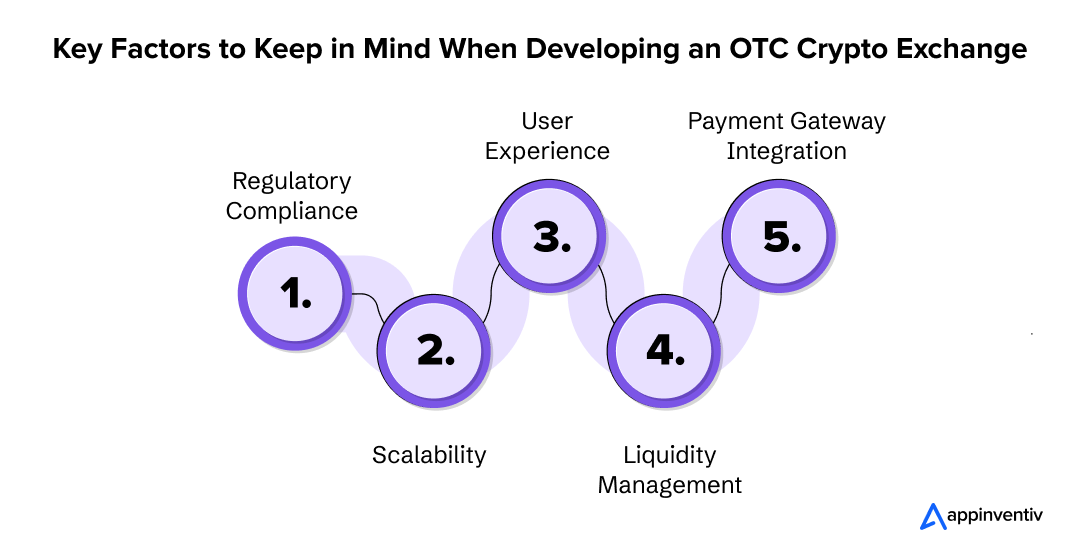

Key Points to Consider When Building an OTC Crypto Exchange Platform

When embarking on the journey of OTC crypto exchange trading platform development, there are several critical aspects that can make or break your platform. Let’s take a look at the key points to consider during the development phase:

1. Regulatory Compliance

One of the most crucial aspects when building an OTC crypto exchange is ensuring that your platform complies with relevant financial regulations. These include:

- KYC/AML Protocols: Know Your Customer and Anti-Money Laundering procedures must be integrated into the platform to verify user identities and prevent illegal activities such as money laundering and fraud.

- Licensing: Ensure that your platform obtains the necessary licenses depending on the jurisdiction in which it operates. Different countries have varying regulatory requirements for cryptocurrency exchanges, and failing to comply can result in legal issues.

2. Scalability

As your secure crypto trading platform exchange grows, the platform needs to scale to handle larger volumes of transactions and users. Choose a robust architecture that allows for seamless scaling without compromising performance. We suggest using a cloud-based infrastructure, along with load balancing mechanisms and high-performance databases, to support increasing user traffic and trade volumes.

3. User Experience

For an OTC trading platform to be successful, especially among institutional clients, the platform must provide an intuitive and professional user experience. The platform should:

- Be easy to navigate with a clean interface and fast transaction execution.

- Allow for customized account management tools tailored to high-net-worth traders.

- Provide instant access to market data, order history, and real-time trade tracking.

4. Liquidity Management

A critical feature of over-the-counter crypto exchange development is ensuring that liquidity is available for large trades without affecting the market price. Integrating liquidity providers or establishing partnerships with market makers can help ensure smooth transactions and minimize slippage.

5. Payment Gateway Integration

To ensure a smooth user experience, integrate multiple payment gateways for fiat on-ramps (USD, EUR, etc.) and crypto payment options. Payment flexibility can drive more users to your platform, offering them options for funding accounts and withdrawing funds seamlessly.

After you have followed all the key considerations and have built a robust over-the-counter trading platform, there is still one thing you will need to accommodate – getting an edge over the growing competitor base.

Ways to Gain an Edge Over Competitors in the OTC Crypto Exchange Industry

The OTC crypto exchange market is competitive, with several established players already catering to institutional clients. To stand out and gain an edge, you can consider the following strategies:

1. Offer Superior Liquidity

Providing deep liquidity is a key differentiator for over-the-counter crypto exchange platforms. Partnering with multiple liquidity providers, implementing cross-exchange liquidity aggregation, or even integrating liquidity pools from decentralized finance (DeFi) platforms can provide your users with access to better pricing and faster execution.

2. White-Glove Customer Service

Offering personalized, high-touch customer support can be a major selling point. Having dedicated account managers for each institutional client, offering tailored pricing models, and providing fast responses to queries and technical issues will significantly enhance the customer experience.

3. Speed and Efficiency

Time is of the essence for high-net-worth traders and institutional clients. Ensure that your crypto OTC trading platform offers fast transaction execution and low latency. Optimize the backend systems for performance, and consider implementing features like instant buy/sell and real-time price updates.

4. Advanced Analytics and Reporting Tools

Providing advanced tools for portfolio management and transaction analysis can offer value to your users. When you add analytics dashboards that display trade performance, portfolio valuation, and real-time market trends in your OTC crypto exchange development scope, you are able to offer deeper insights that can attract institutional clients looking for more sophisticated tools.

5. Enhanced Security Features

Beyond basic security, implementing advanced fraud detection tools, biometric login, and insurance for stored funds can set your platform apart. Offering a higher level of security than competitors can be a strong selling point, particularly for institutional investors who prioritize the safety of their funds.

6. Expanding Currency Support

Support for a wide range of cryptocurrencies, as well as emerging digital assets such as NFTs or stablecoins, can attract diverse users. Being one of the first platforms to offer new cryptocurrencies for OTC trading can give you an edge in the market.

7. Global Reach

While many crypto OTC trading platforms focus on specific regions, offering a global reach with local fiat integration in various countries can make your platform attractive to international investors. Having localized services and compliance ensures that clients from different countries can use your platform without issues.

8. Tailored Solutions for Institutional Clients

Develop features and services specifically for institutional traders, such as customizable pricing, the ability to trade on behalf of multiple clients, and options for segregating funds for different accounts. These features can cater to larger enterprises or crypto hedge funds and differentiate your platform in the market.

When we talk about creating the business model of a crypto OTC trading platform, there’s one deployment decision that entrepreneurs often struggle to take. Let’s look into what that is, next.

White-Label vs Custom-Built OTC Crypto Exchange: Which Should You Choose?

Entrepreneurs who wish to enter the OTC crypto exchange space face a key decision: Should they deploy a white label OTC trading platform, or should they build their own platform from scratch? Both options come with their advantages and considerations. But the decision ultimately should be taken by stepping into users’ shoes.

White Label OTC Crypto Trading Platform

A white-label OTC crypto exchange is a pre-built, ready-to-deploy platform that can be customized with your branding, logo, and features. White-label solutions offer several benefits:

- Cost-Effective: White-label solutions are more affordable than developing a platform from scratch since the development and testing phases have already been completed.

- Faster Time to Market: You can launch your exchange quickly since the infrastructure is already set up. This is ideal for entrepreneurs who want to get into the market fast.

- Proven Technology: White-label solutions are often built on reliable technology, reducing the risk of bugs and security vulnerabilities.

However, there are some downsides:

- Limited Customization: While you can add your branding, the core functionality and design might be restrictive.

- Brand Identity: The platform may look similar to other exchanges that are using the same white-label solution, making it harder to stand out in the market.

Custom-Built OTC Crypto Exchange

A custom-built platform offers complete flexibility in terms of design, functionality, and scalability. Here are the advantages of opting for a custom OTC crypto exchange development:

- Complete Control: You have full control over the platform’s features, design, and security, allowing you to build a unique platform that stands out in the market.

- Tailored Features: You can integrate specific features that cater to your target audience, such as advanced trading tools, specialized customer support, or integration with unique liquidity providers.

- Long-Term Scalability: As your platform grows, you can expand and scale according to your needs, ensuring that it can support future demand.

The downside is the higher cost and longer development time, as building a custom platform from the ground up requires significant resources and expertise.

Which is Right for You?

If you’re looking to quickly launch a platform with limited resources and a focus on minimizing upfront investment, a white label OTC trading platform might be the right choice. However, if you have a longer-term vision and want full control over the features and branding of your platform, investing in a custom-built OTC exchange could be the best option for you.

We understand that taking these decisions in addition to the complex development process can be challenging. That is where our expertise comes in.

over-the-counter crypto exchange development requires a deep understanding of blockchain technology, crypto trading, and the specific needs of institutional clients. By focusing on advanced features like multi-currency wallets, multi-layer security, seamless transaction execution, and robust compliance protocols, we can help you create a platform that meets the high expectations of institutional traders. Additionally, our careful planning and investing in security, user experience, and technology will help you stand out in this competitive and rapidly evolving market.

Ultimately, whether opting for white-label solutions or building a custom platform, the end goal should be the same – ensuring that the platform is secure, scalable, and user-centric. With the right strategy and execution, we can assure that your OTC crypto exchange thrives in this lucrative and fast-growing space.

FAQs

Q. What is an OTC crypto exchange, and how does it work?

A. An OTC crypto exchange is a platform that facilitates direct trades between buyers and sellers outside of a standard exchange. Unlike traditional exchanges, OTC platforms don’t display trades in a public order book, allowing large transactions to be completed without causing significant price fluctuations. In OTC trading, a broker or intermediary typically helps match buyers with sellers and oversees the transaction to ensure a fair exchange rate and secure settlement. OTC exchanges are popular with high-net-worth individuals and institutions due to the privacy, flexibility, and liquidity they offer.

Q. Why should I choose Appinventiv Technologies for OTC crypto exchange development?

A. Appinventiv Technologies is a leading name in OTC exchange development, offering extensive experience in blockchain and crypto solutions. Our team specializes in building secure, scalable, and regulatory-compliant OTC platforms tailored to your needs.

With a focus on cutting-edge technology, robust security features, and seamless user experience, we ensure your platform stands out in a competitive market. Additionally, our end-to-end development approach covers everything from consultation and design to deployment and post-launch support, providing you with a comprehensive solution.

Q. What are the advantages of over-the-counter crypto trading?

A. There are several benefits of developing an OTC crypto exchange, especially for high-volume traders. It provides enhanced privacy, as trades occur directly between parties rather than through a public exchange order book. OTC trading also minimizes price volatility, as large trades can be executed without significantly impacting market prices.

Traders benefit from personalized service and tailored liquidity options, making OTC ideal for institutional investors or individuals looking to trade significant amounts without slippage. Additionally, OTC trading often offers faster settlement times and higher limits than traditional exchanges.

Q. What risks are associated with crypto OTC trading?

A. Crypto OTC trading carries certain risks, including counterparty risk, where one party may default on their side of the transaction. Since trades are conducted outside of public exchanges, regulatory oversight can be limited, increasing the risk of fraud if the parties are not properly vetted.

OTC trades also depend heavily on intermediaries, so choosing a reliable, transparent broker is essential. Market risk is another concern, as fluctuating crypto prices can impact the value of large trades. Lastly, limited liquidity in certain crypto assets can cause challenges in matching trades at desired prices.

Q. How long does it take to build an OTC crypto exchange platform?

A. The development time for an OTC crypto exchange platform depends on the complexity and specific features required. On average, it can take anywhere from three to six months for a fully functional OTC platform, assuming standard features like KYC/AML compliance, secure wallet integration, and a robust trading engine.

Custom requirements, additional security measures, or advanced functionalities like automated matching and reporting can extend the timeline. Working with an experienced development partner, however, can streamline the process and reduce development time.

Q. How is an over-the-counter crypto exchange different from a normal exchange?

A. An over-the-counter crypto exchange differs from a normal exchange in that it facilitates direct trades between buyers and sellers without using a public order book. Traditional exchanges operate by matching orders from multiple users, which can lead to slippage and affect market prices, especially for large transactions.

OTC exchanges offer greater privacy, less volatility, and more flexibility, making them ideal for high-volume trades. Additionally, OTC platforms often provide personalized support and can manage larger trade limits, catering primarily to institutional investors or high-net-worth individuals.

The Rise of Blockchain in Digital Marketing - Benefits, Use Cases and Challenges

Blockchain technology is revolutionizing digital marketing by transforming strategies through its decentralized and secure framework. It provides marketers with unparalleled transparency in campaign tracking and data management, guaranteeing increased security and privacy for users. As the digital landscape is advancing at a fast pace, blockchain in marketing offers the digital marketers with the means to…

Blockchain Interoperability: The Key to Connect Siloed Blockchain Networks

Blockchain has been a revolutionary response for industries facing the growing pressure of centralized operations’ limitations. By building an ecosystem which runs on zero trust, the technology introduced the world with processes that were incredibly neutral, change-proof, and 100% transparent when compared to their predecessors - traditional computing environment. Having reached a stage where blockchain…

How to Build a DeFi App? Costs, Features, Process, Types

The current financial system, with its inefficiencies, high fees, limited accessibility, and lack of transparency, often leaves significant portions of the global population, especially in underbanked areas, at a disadvantage. Decentralized finance (DeFi) emerges as a solution to these issues, utilizing blockchain technology to remove intermediaries, thereby reducing costs and enhancing security. This shift towards…