- What is Financial Analytics?

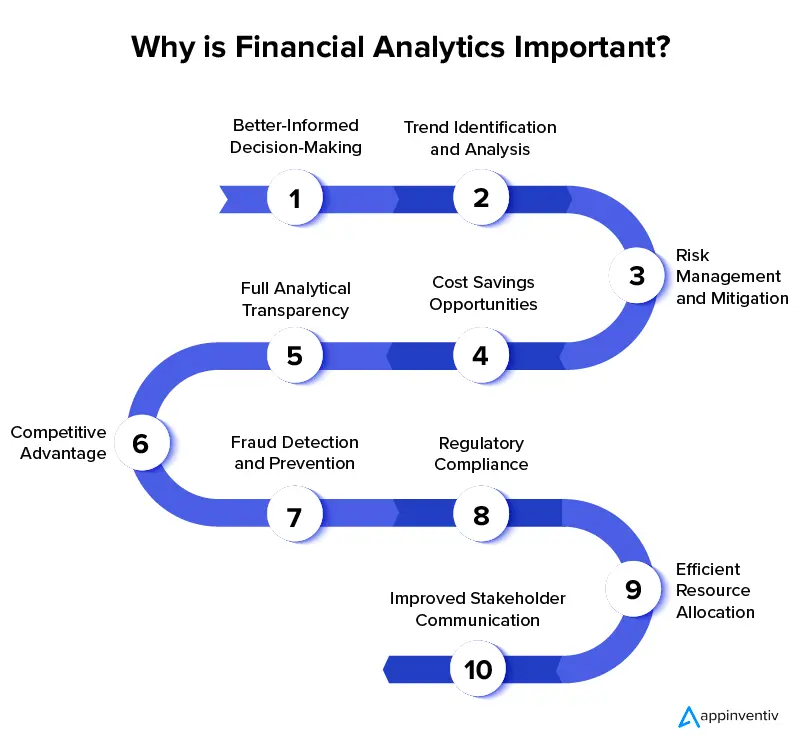

- Top Reasons Financial Analytics is Becoming Important

- 1. Better-Informed Decision-Making

- 2. Trend Identification and Analysis

- 3. Risk Management and Mitigation

- 4. Cost Savings Opportunities

- 5. Full Analytical Transparency

- 6. Competitive Advantage

- 7. Fraud Detection and Prevention

- 8. Regulatory Compliance

- 9. Efficient Resource Allocation

- 10. Improved Stakeholder Communication

- How can Appinventiv help?

- FAQs

Financial analytics for enterprises is becoming key to the success of modern businesses. Most companies are investing in robust big data analytics tools for potential cost savings, increased revenue, and productivity benefits. The data analytics market is experiencing a surge in growth from 2022 to 2027 to reach $221.23 billion, according to Technavio’s recent report. Analysts suggest that the rate of development will accelerate, with a CAGR of 13.5%.

The extensive use of technology plays an instrumental role in driving market growth. At the same time, certain challenges such as stiff competition to customer preference shifts and regulative obligation compliance – financial analytics for businesses has become a required tool for making informed decisions and bettering performance. The analysis of financial data provides essential insights into operations and ascertainment of industry trends, managing risk, and resource optimization. In other words, it’s a key factor when trying to stay ahead of the game and remain competitive.

Financial analytics for enterprises carries several advantages, such as increased access to detailed information leading to more knowledgeable decisions, improved forecasting abilities, and cost savings potentials. What’s more, it further enhances comprehensive financial planning processes under the scope of regulatory reconciliation. Find out in our article what financial analytics can accomplish for your business.

What is Financial Analytics?

Financial analysis is a fundamental tool that provides different perspectives on a company’s financial data. With such clarity and precision, stakeholders can make optimized decisions enhancing their ROI. The importance of financial analytics for enterprises cannot be understated and it has a far-reaching impact on all aspects of the industry.

It holds great value in assessing an entity’s financial position. Moreover, it can help predict future returns with predictive analytics and challenges encountered in the business operation. Furthermore, leveraging finance analytics tools offers more value when collecting information about cash flow, profit margins, expenses, and other aspects within the organization by removing any existing complexities.

Financial analytics for businesses is the backbone of strategic financial planning and analysis, providing businesses with a comprehensive view of their finances. The best analytical tools combine disparate data sources, allowing you to transform raw data into insights and actionable information.

Specialized functions identify patterns, display interactive visualizations, trigger alerts and actions in other parts of the system, create predictive analytics, run machine learning algorithms, and embed analytics into other applications. With these capabilities, companies optimize performance by accurately forecasting key financial metrics such as actuals vs. forecasts and cash flow valuations.

Top Reasons Financial Analytics is Becoming Important

The modern business environment relies heavily on financial analysis to inform strategic decision-making. Across all industries, financial planning and forecasting are crucial for success, with sophisticated techniques being employed globally.

Financial analysis can shape company objectives, identify tangible assets such as cash and equipment holdings, assess financial statements in-depth, and track the journey of profit margins, cash flow, and financial returns. In today’s fast-evolving world of corporate finance, companies must understand why proper financial analysis is increasingly important every day. Here are a few reasons and benefits of financial analytics in enterprises:

1. Better-Informed Decision-Making

In today’s bustling business environment, it is even more necessary than ever for enterprises to make prompt decisions based on reliable insights. One invaluable tool for doing this is financial analytics for businesses. By analyzing financial data, enterprises can observe performance patterns and trends and make decisions supporting long-term success.

Financial analytics for enterprises allows organizations to study their current finances, including revenue, expenditures, profit margins etc., permitting them to reallocate resources or introduce new strategies that may help rectify issues they identify, such as inefficient processes or prices being too high. Similarly, financial analytics data can recognize untapped markets and target potential customers with new services or products.

All in all, using financial analytics for enterprise is a key component for enterprises wanting to take calculated risks. It permits the implementation of data-driven decision-making that could give their venture an extra push and increase the likelihood of success over the years ahead.

2. Trend Identification and Analysis

Identifying and assessing trends can be a powerful tool for financial analytics. By analyzing data points over time, enterprises can gain valuable insights into their market position, financial performance and potential growth opportunities.

For example, retailers may use financial analytics to observe consumer spending patterns over a year – perhaps recognizing that consumer demand peaks during certain holidays or events. With this knowledge, they can create targeted marketing campaigns to capitalize on that demand. Similarly, manufacturing companies might employ financial analytics to identify areas where their production processes could be improved – such as reducing unplanned downtime or increasing efficiency.

Growth opportunity assessment also relies heavily on trend identification and analysis. Financial services companies may analyze customer behavior and market conditions to identify new investment products that meet emerging customer needs, unlocking new avenues of revenue growth.

3. Risk Management and Mitigation

Financial analytics used in business provide the tools to assess risks and execute reactive measures strategically. For instance, a bank can analyze its loan portfolios with financial analytics and take defensive actions against high-risk loans. The institution can then implement tighter credit standards or raise the requirement for collateral to mitigate any associated economic losses. Similarly, retailers rely on financial analysis of sales data to distinguish products with excessive returns; subsequently, necessary measures should be taken to improve product quality or update return policies to prevent consumer dissatisfaction and monetary problems.

Risk management is an essential element of financial analytics that companies should consider. By thoroughly evaluating available financial data, firms can identify potential hazards and implement certain safeguards to reduce their chance of suffering from economic losses.

4. Cost Savings Opportunities

Properly allocating resources is an essential part of financial analytics for enterprise that can lead to cost savings and improved profitability. With the help of financial analytics, an enterprise can assess its spending and determine areas where it should invest funds to improve efficiency and reduce expenses. For example, a logistics company may reduce fuel expenses by investing in fuel-efficient vehicles, optimizing delivery routes, and enhancing supply chains. On the other hand, healthcare organizations may find that negotiating better prices with suppliers or investing in less expensive medical equipment alternatives will save them money.

Overall, cost savings opportunities are a core component of financial analytics for businesses; by gaining deeper insights into their operations and investments, enterprises can make data-driven decisions that will drive their business forward for long-term success.

5. Full Analytical Transparency

Financial analytics allows companies to look into their past financial data and use it to predict their future accurately. This predictive nature of analytics can help improve budgeting and forecasting, giving an organization what they need to prepare for inevitable changes in the market or adjustments to resource allocation.

Take a manufacturing company, for instance – if financial analytics presents reliable indications that demand is growing quickly, they can use this information to plan increases in production capacity and prevent shortages. Similarly, a service-oriented business applies the same concept and has reason to believe that the volume of services requested may be unusually high. In that case, it can make moves like working with temporary staff or outsourcing work to maintain customer satisfaction during peak times.

Overall, investing in financial analytics for accurate budgeting and forecasting will allow businesses more clarity when allocating resources efficiently, helping them maximize short-term profits while keeping expenses at a minimum. Utilizing data-driven decisions from analytics will help businesses grow successfully over a longer period, delivering success repeatedly.

6. Competitive Advantage

Financial analytics provides companies with a distinct competitive advantage. By leveraging financial insights, businesses can understand trends and patterns that may go overlooked by their competitors. For example, a retail company can employ analytics to observe customer buying behaviors and identify certain demographics that prefer online transactions over in-store purchases. With this newfound data, enterprises can strategically allocate resources toward their digital infrastructure or develop marketing campaigns to gain new customers for greater success.

Similarly, financial services companies may use analytics to understand areas where improvements must be made regarding customer satisfaction with potential issues identified from analysis relating to their mobile app, allowing further development of the product or redesigned features resulting in a strengthened advantage against the competition.

Financial analytics for businesses disregards traditional methods allowing enterprises to identify unseen trends and forces, which enables them to hone a higher competitive edge within the marketplace.

7. Fraud Detection and Prevention

Organizations can greatly benefit from financial analytics regarding fraud detection and prevention. Fraudulent activities have the potential to cause severe losses, as well as damage a company’s reputation. The role of Financial analytics in enterprises is huge and can provide insight into suspicious customer behavior, such as large transactions from multiple locations or internal fraud, like embezzlement. The goal is to identify financial anomalies and take corrective action to prevent losses or reputational damage. To sum up, financial analytics use cases in business for fraud detection and prevention brings great advantages to organizations; It allows them to protect themselves from fraudulent activity, thus driving their long-term success.

8. Regulatory Compliance

Staying compliant with regulations is an important part of running a successful business. Companies need to be sure that they are aware of all applicable laws, rules, and regulations and must take appropriate action to remain compliant. Financial analytics use cases in business can provide insights into the financial data and help identify areas where a company may need to meet requirements.

By having access to their financial information and uncovering any potential issues in complying with regulatory guidelines, companies can take the initiative proactively – making changes ahead of an audit or addressing areas where they may be non-compliant quickly. Businesses can also use financial analytics to prepare for audits more thoroughly, ensuring they avoid unexpected fines or penalties due to their failure to comply with regulations. Overall, leveraging financial analytics helps businesses stay up-to-date on their regulatory obligations and navigate potential legal repercussions by being proactive before it’s too late.

9. Efficient Resource Allocation

Maximizing resource efficiency is the primary advantage of leveraging financial analytics for businesses. With financial analytics, companies can evaluate their data to identify ways to reduce costs, bolster operational productivity, and open growth avenues.

For instance, in production, a manufacturing firm might use financial analysis to assess its spending on raw materials and uncover opportunities for budget optimization. From there, they could seek lower prices with suppliers or refine their factory processes to achieve cost savings while still producing quality goods.

Organizations can also employ financial analytics to discover potential expansion areas. Take for example, a technology company that may rely upon data modeling to scan the market and detect any new opportunities for investment. Such as R&D initiatives or marketing campaigns – that could help them grow down the line.

Overall, efficient resource allocation is an integral benefit when it comes to releasing the full potential of financial analytics for organizations. By accurately analyzing and understanding their data sets, companies have a good chance of maximizing key resources and positioning themselves for continued success in the long run.

10. Improved Stakeholder Communication

Financial analytics is an invaluable resource for businesses regarding stakeholder communication. It allows companies to present their reports clearly and easily, providing detailed insights into financial performance to build trust and confidence with stakeholders. Additionally, enhanced forecasting capabilities enabled by analyzing historical data help these stakeholders understand a company’s future trajectory. By using analytics tools, enterprises can better inform strategic decisions and increase overall organization transparency – positioning them for long-term success.

How can Appinventiv help?

Today, enterprises of all sizes need to tap into the power of financial analytics to streamline their financial operations. This technology empowers enterprises to gain invaluable insights into their financial performance, find new opportunities to optimize budgets, reduce risks and more.

With our Fintech Software Development Services, we help organizations take advantage of financial analytics to make better-informed decisions. This directly contributes to improved resource allocation, stakeholder communication, regulatory compliance and even captures a competitive advantage in their market.

Appinventiv leverages financial analytics for businesses with our data analytic solutions. We also provide data-driven insights into long-term growth initiatives like increasing profitability or managing risks across a company’s operations.

As companies strive for success through increased efficiency and effectiveness using this technology, organizations that leverage it correctly will unlock its potential for driving profit margins and creating sustained growth in the years ahead.

FAQs

Q: How is financial analysis used in business?

A: Financial analysis provides essential insight into the financial standing and performance of companies. This process examines financial data to detect trends, uncover patterns, and identify areas for improvement. By leveraging this information, decisions can be made with greater accuracy, resources can be allocated more efficiently, and long-term success can be achieved.

Q: Why is finance analytics important in business?

A: Financial analytics is a key component of successful business operations. It can help organizations make sound decisions, detect fraudulent activities, identify key trends and opportunities for growth, and adhere to applicable regulations. As such, financial analytics for enterprise plays an integral role in sound financial management and long-term success.

Q: What is an example of financial analytics in business?

A: Financial analytics examples in businesses include balance sheets and income statements to evaluate trends in key performance indicators.

CRM in Banking Industry– Benefits, Challenges, Features and Integrations

A misconception is prevalent about CRM (Customer relationship management) that only certain kinds of businesses need one. But in reality, a CRM system is a must if you have customers who rely on your products or services. Unarguably, CRM is an integral aspect of every industry, and the banking sector is no exception. CRM in…

How Much Does It Cost to Build a Bill Payments App Like My Optus?

In today’s fast-paced digital landscape, convenience is king. From ordering food and buying groceries to booking medical appointments and managing finances, the demand for user-friendly applications is skyrocketing. Among this wide array of applications, digital payment apps emerge as a transformative force, offering unparalleled convenience to access financial services and manage transactions on the go.…

How Much Does It Cost to Build A FinTech App Like Revolut?

FinTech businesses globally encounter a myriad of challenges that impede their growth and sustainability. These include cumbersome banking procedures causing transaction delays and hindering cash flow management, stringent lending criteria from traditional financial institutions limiting access to capital for expansion, navigating complex regulatory requirements leading to potential legal ramifications, and maintaining outdated financial systems hampering…